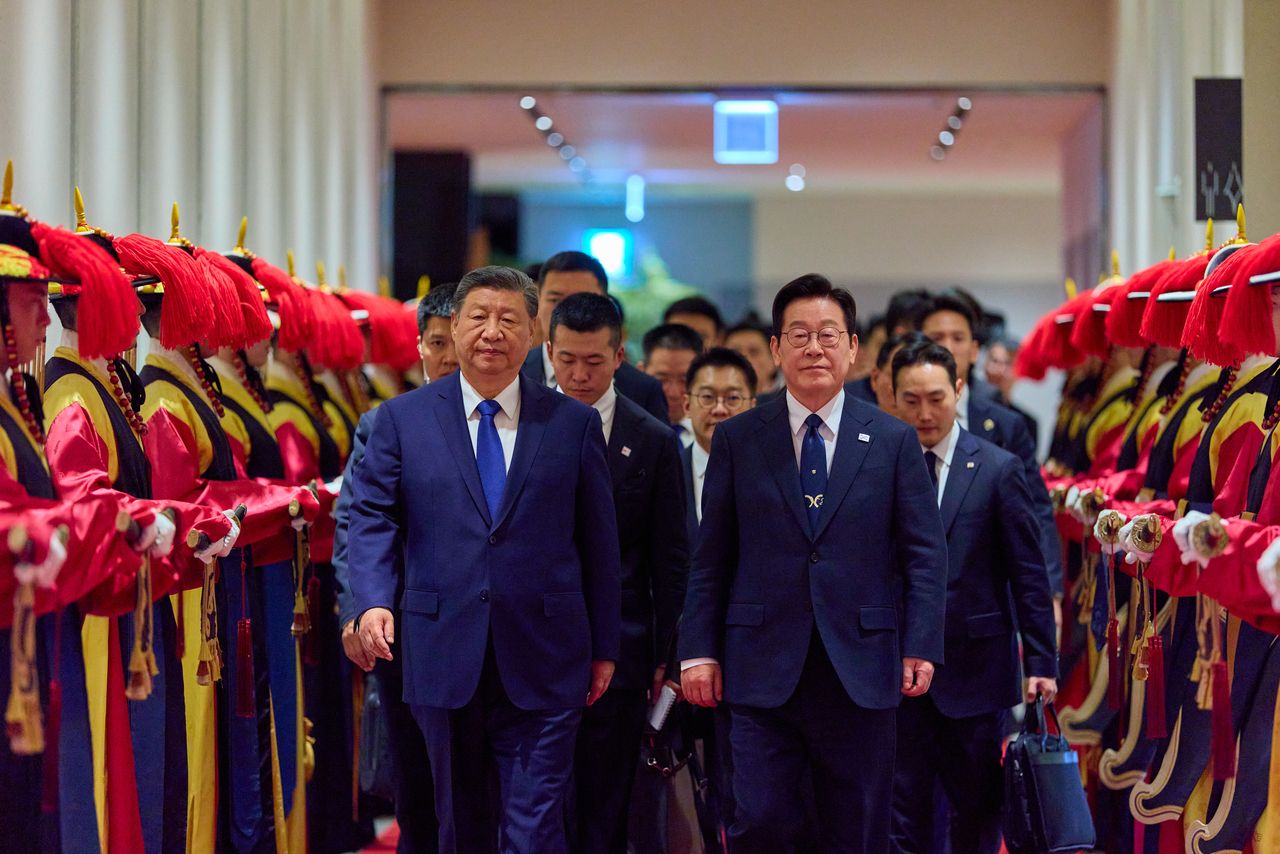

President Lee Jae Myung’s state visit to China fuels optimism over possible loosening of 8-year unofficial ban With President Lee Jae Myung set to visit China to meet Chinese President Xi Jinping on Sunday, optimism is building that long-frozen cultural exchanges between the two countries could finally thaw, nearly a decade after Korea’s 2017 decision to deploy the THAAD missile defense system triggered an unofficial crackdown widely known in Korean as “han-han-ryeong.”

With President Lee Jae Myung set to visit China to meet Chinese President Xi Jinping on Sunday, optimism is building that long-frozen cultural exchanges between the two countries could finally thaw, nearly a decade after Korea’s 2017 decision to deploy the THAAD missile defense system triggered an unofficial crackdown widely known in Korean as “han-han-ryeong.”

Cheong Wa Dae said Tuesday that Lee will travel to Beijing for a four-day state visit, where the two leaders are expected to discuss ways to “strengthen momentum toward restoring a strategic cooperative partnership.” The agenda is likely to span supply chains, the digital economy and environmental cooperation, but the meeting has also reignited industry hopes that restrictions on Korean cultural content in China may ease.

The prospect alone moved markets. Shares of major Korean entertainment companies rallied after the announcement, led by YG Entertainment, which jumped 7.26 percent to 69,400 won ($47) on Wednesday from the previous session. JYP Entertainment rose 2.11 percent to 72,600 won, while SM Entertainment gained 5.47 percent to 135,000 won.

Industry watchers say a breakthrough is increasingly plausible.

“A summit between the two leaders could have a decisive impact on easing tensions with China,” said Lee Moon-haeng, a professor of media communication at Suwon University. “There has always been a strong demand for Korean culture in China. Political barriers pushed audiences toward unofficial or illegal channels, but the appetite never disappeared.”

If relations warm at the top, Lee added, the rebound could be swift. “The popularity of K-culture would not start from zero. Long-suppressed demand would be released very quickly.”

According to Lee, the cooling of China-Japan relations has reshaped the regional landscape. “With China-Japan relations deteriorating, the balance of regional dynamics has shifted, and that has unexpectedly fast-tracked a thaw in Korea-China relations,” she said.

There are also concrete signs fueling optimism. Professor Lee noted that the Dream Concert 2026 Hong Kong show is set to air on China’s Hunan TV, a major broadcaster with strong global reach. The February event, co-hosted by Korea Entertainment Producers Association and China-based Changsha Tonggu Culture Co., is one of Korea’s most popular K-pop concerts, with this year’s lineup featuring artists including Taemin, Hwasa and EXO-CBX.

“This could be a meaningful turning point,” Lee said. “It signals change not just to fans, but to the global market. It’s even reasonable to expect K-pop concerts to resume in China within the next year.”

Others urge caution, noting that ‘han-han-ryeong’ was never a formal policy.

“Even if the leaders meet, this is not necessarily something that would be addressed head-on at the summit,” said a media industry official, speaking on condition of anonymity. “If anything changes, it is more likely to happen quietly and incrementally.”

The term “han-han-ryeong” refers to a series of informal measures China began enforcing around 2017 after Korea confirmed its deployment of the US missile defense system THAAD. Without announcing it officially, Chinese authorities effectively blocked Korean dramas, films, games and music, limited Korean celebrities’ TV appearances, restricted group tours to Korea and tightened customs and regulatory scrutiny on products such as cosmetics.

The fallout was significant. The entertainment, tourism, retail and beauty sectors took heavy hits, prompting major Korean brands to pull out of China. The Korea Development Bank’s KDB Future Strategy Institute estimated losses of up to 22 trillion won across the affected industries.

Recently, however, expectations of easing have grown amid shifting economic and geopolitical realities. A central factor frequently cited is the intensification of US-China tensions after President Donald Trump’s second inauguration, encouraging Beijing to strategically recalibrate its relations with other nations, including Seoul.

China’s decision last November to include Korea in its visa-free entry program for the first time since diplomatic ties were established in 1992, and Seoul’s granting of visa-free travel for Chinese tour groups this year are widely seen as part of that broader reset, along with Xi’s recent visit to Korea for the APEC summit.

Most Commented